Data Insights

How Finance Leaders can use their own data for intelligent decision making

Key scenarios where finance and business leaders might want to use the power of business intelligence In this second article it’s time to look at some key scenarios where finance and business leaders might want to use the power of business intelligence to

How easy is it for Finance Leaders to get on board with Business Intelligence?

a bi-weekly series to help you get started on your data strategy journey.

In the first article in this series we looked at how Finance Leaders are becoming empowered to get on board with Business Intelligence.

With some straightforward pointers and not too much in the way of outside help, you can start to self-serve your own reports and financial information when you need it most.

If you missed it then do click on the link above.

Now it’s time to look at some key scenarios where finance and business leaders might want to use the power of business intelligence to achieve insights they can act upon.

Financial Reporting and Analysis:

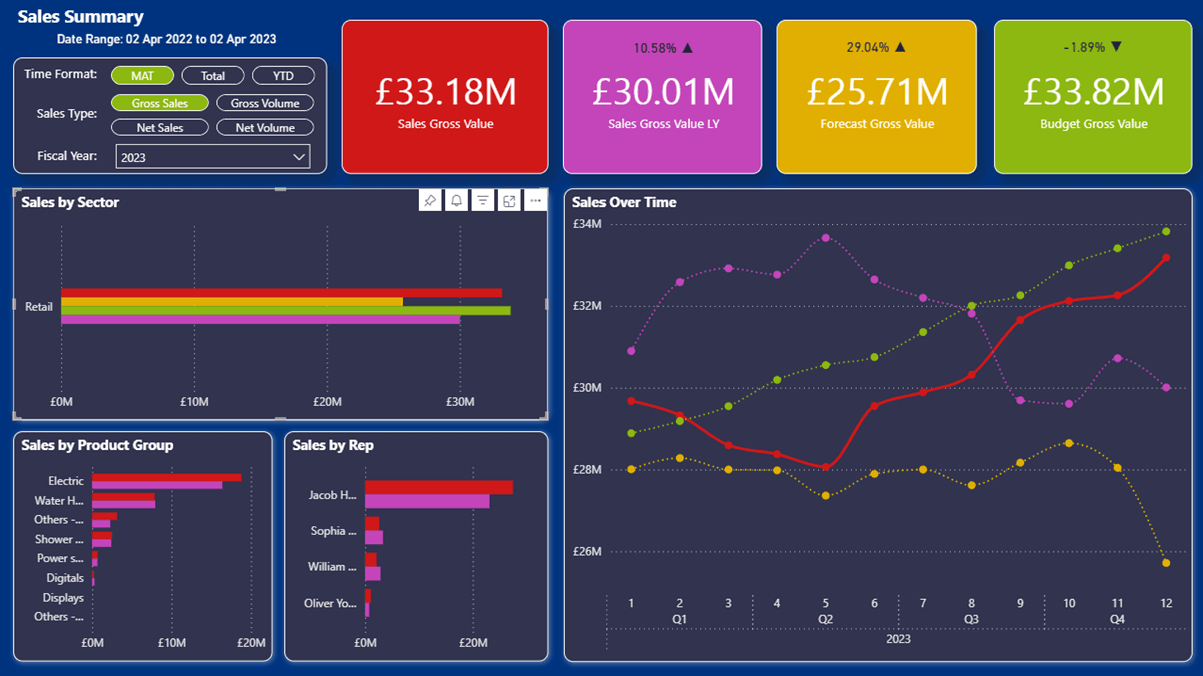

BI tools can automate the generation of financial reports, making it easier to analyse financial statements, income statements, balance sheets, and cash flow statements. This helps finance leaders monitor the company's financial health and identify trends or anomalies.

Budgeting and Forecasting:

BI can assist in creating more accurate and dynamic budgets and forecasts. Finance leaders can use historical data and predictive analytics to model different scenarios and make informed decisions about resource allocation and financial planning.

Expense Management:

BI can provide insights into expense patterns, helping finance leaders identify areas for cost reduction or optimization. This includes tracking expenses across departments, projects, or regions to identify inefficiencies.

Revenue Analysis:

Finance leaders can use BI to analyse sales and revenue data, including customer segmentation, product performance, and sales channels. This can help in identifying high-value customers and optimizing pricing strategies.

Cash Flow Management:

BI tools can help predict cash flow fluctuations and ensure that the company maintains sufficient liquidity. Finance leaders can monitor cash flow patterns and take proactive measures to address potential cash flow issues.

Risk Management:

BI can assist in identifying and assessing financial risks. By analysing data related to market conditions, credit risk, and operational risk, finance leaders can make informed decisions to mitigate potential threats to the company's financial stability.

Compliance and Regulatory Reporting:

Finance leaders can use BI to ensure compliance with financial regulations and reporting requirements. BI tools can automate the extraction and analysis of data needed for regulatory filings.

Performance Metrics:

Finance leaders can define and track key performance indicators (KPIs) using BI dashboards. This allows them to monitor financial performance in real-time and make adjustments as needed to meet strategic objectives.

Mergers and Acquisitions (M&A):

During M&A activities, BI can help finance leaders assess the financial health of potential acquisition targets, evaluate synergies, and model the financial impact of various deal structures.

Customer Profitability Analysis:

BI can provide insights into the profitability of different customer segments. Finance leaders can allocate resources more effectively by understanding which customer groups contribute the most to the bottom line.

Supply Chain Optimization:

For businesses with complex supply chains, BI can help in optimizing inventory levels, identifying bottlenecks, and reducing procurement costs, which can have a significant impact on financial performance.

Fraud Detection:

BI tools can be used to detect financial anomalies and potential fraud by analysing transaction data and identifying irregular patterns.

Capital Allocation:

Finance leaders can use BI to determine the best allocation of capital resources, whether it's for investments in new projects, research and development, or debt repayment.

Power BI's accessibility and user-friendly features make it a valuable tool for finance professionals looking to leverage data for better decision-making.

So long as you follow some basic guidelines on defining objectives and ensuring data integration you will be on the way towards enhanced business intelligence for your company. Finally you have user-friendly visualizations to help you collaborate with colleagues and make more informed business decisions. Don’t forget to keep your training up to date for you and your team. PTR can help! Please get in touch HERE

We offer Data Strategy Consulting, Data Analytics Consulting, Power BI consulting and Microsoft Fabric Consulting and that’s just for starters. Please contact us for your bespoke training course.

Please contact caroline.atkinson@ptr.co.uk to find out how we can help you improve your data insights. Our Business Intelligence Consultants are here to guide you on your data journey.

Share This Post

Mandy Doward

Managing Director

PTR’s owner and Managing Director is a Microsoft certified Business Intelligence (BI) Consultant, with over 35 years of experience working with data analytics and BI.

Frequently Asked Questions

Couldn’t find the answer you were looking for? Feel free to reach out to us! Our team of experts is here to help.

Contact Us